Best Practices for Structuring IVR Menus in Bank Industry

5 min read

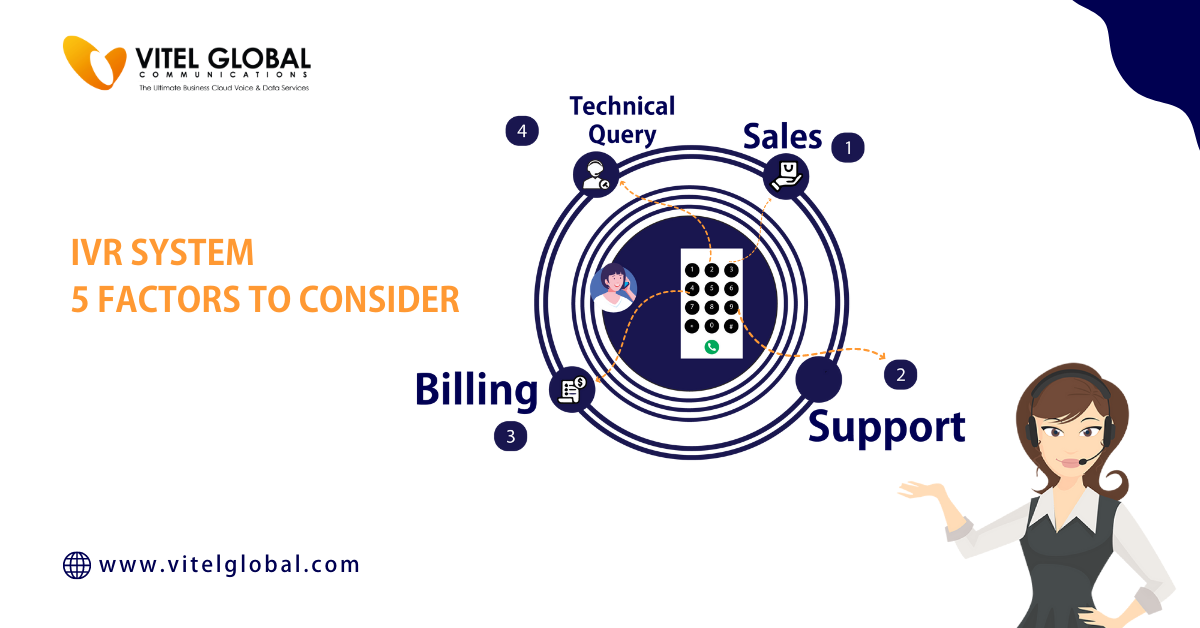

Interactive Voice Response (IVR) is an automated telephone menu that connects customers to the desired department. To succeed, design IVR menus to anticipate how people will navigate them and how they will feel during interactions.

If small business phone service providers provide multiple routes through your menu, try different arrangements, so callers have only a few choices. Making it too difficult for people to make their selections can reduce the effectiveness of your system and lead to frustration and lost sales.

Be sure that all options you offer are easy for customers to repeat quickly to choose from.

Menus that will help you in the Bank industry:

The most essential options on the menu should be at the top of the list so most callers can get what they need right away.

Make buttons large, bold, and easy to read. The font size should be set to the size of the largest font used on your primary phone system. If it is 12 points but no larger fonts, use 10 points – it is still readable. Use 4 points if the most prominent font is smaller. If you can’t use a larger text setting, at least try to increase or change the font’s weight to not “flatten” by using a small number of characters in ample space.

Put important action buttons in their location on your menu. To make it easier for callers to reach these items, consider placing them on top of the list or at the beginning of the second level of your menu.

Try to put only a few options on one list. If you have a set of choices that require considerable explanation to help callers understand them, consider breaking that set into separate menus or web pages and linking to each page from the relevant section.

Be sure that your IVR allows callers time to hear all their options before dialing other digits, and avoid segmenting your menu into clearly defined segments without any overlap in content or concept.

An effective IVR should allow callers to retake an offered option if they need more time to get back to the top of the list or the beginning of a second level. Best business phone features will involve an option for helping people get back up top, like offering a “back” button or allowing calling again in 60 seconds.

Best practices for structuring your IVR menu:

Standardize Language Over Time:

Choose standard terms that are easy for customers to recognize and remember. Avoid changing terms frequently to avoid confusion and customer complaints.

Prioritize Important Options:

Prioritize options based on customer needs and behavior. For example, 3 customer needs can be prioritized in this order: 1) PIN, 2) Balance inquiry, and 3) Transfer funds.

Prominently Display Options:

Display options that are most Commonly Used or Most Relevant to Customers. Ensure frequently used options like balance or recent transactions are displayed prominently at the top of the menu. (For instance, if customers often call with the same request, like transferring funds between accounts, or know that they want to transfer funds but forget from which account they want to do it – then those options should be directly displayed so customers don’t have to go through an extra menu).

Use a list of common choices to display options often relevant to customers (such as check-banking, customer service line, and transfer funds).

Prioritize Options Based on Behaviour:

Customers tend to use the same options repeatedly for their exact needs. Use surveys or other research methods to determine what customers do most often or at least some of their everyday needs. For instance, if the bank is aware that customers typically utilize a specific option for balance inquiries or fund transfers between accounts, it should display those options within a single menu item.

Make it Simple:

It is easy for Customers to Understand What’s Being Offered. Make sure your IVR menu is easy to follow. Eliminate unnecessary options or steps that may confuse customers. For example, when the system already stores the amount, avoid asking customers to input their account number and instead, instruct them to press a key like “0” or “1” for their desired option.

However, if some options require specific details, make sure they are clearly stated and easy to understand. Here’s an example of a good way of doing this:

Use Easily Recognizable Voice Prompts:

Ensure your IVR voice prompts easily convey relevant information and what will happen next. Make it easy for customers to understand what buttons to press after hearing the prompts. For example:

If you have an option requiring a more detailed selection process (like selecting the account), use separate menus for each account and keep customers on the line while accessing each account.

Tips for Onboarding and Upselling Customers:

- Keep the Interactive Voice Response menu short. If possible. More than 200 gets tedious to listen to.

- Keep the menu simple. It should be easy to understand and easy to navigate once you pass the first screen or two of the options. If your company is a relatively large bank, should you include non-banking products such as car loans for customers opening a new account? Why not? Since banks have created their market, why not give them an additional option? The reason: They’re used to banking. They know how it works.

- Banks and credit unions should provide a “View Account” button at the top of most of their IVR menus, including yours. There is a good reason for this. Customers need to understand that they are entering your bank’s account information and not just providing a card number or other type of authentication through the IVR system.

- Make the menu simple and easy for customers to navigate. Smaller banks should include elementary IVR menus for their customers, such as:

- Account Information

- Contact Customer Service

- Services Offered

Tips for Lead Generation and call Conversions:

- Make the call as simple as possible. Have only the information you need available instead of a seemingly unending list of questions/options.

- Include an option for customers to leave their number on the third or fourth menu screen, if not sooner so that you can call them back with more information about whatever product they are calling about. It works best when talking to customers about something like a new credit card. You have the choice to leave your number if this pertains to a new credit card, and we’ll reach out to you within 24 hours to provide further details.”

- Include a thank you screen at the end of your IVR that provides basic information about what you do and who your bank is. Stay out of your way to do this, however. Please keep it simple.

- Offer incentives on the IVR for customers who will make a lead or account transfer, e.g., free ATM receipts, credit card replacement cards, checks, and more.

- Integrate CRM with business phones to help you identify the best customer for a live call.

Use more than a simple address book in your CRM system. There are now products and services that go far beyond just an address book. It can also include credit card numbers, driver’s license numbers, phone numbers, age ranges, birthdays, and more, further increasing the accuracy of your lead capture process.

Published: October 17th, 2023

Subscribe to Our Latest Updates

Get monthly product and feature updates, the latest industry news, and more!