Cloud Phone System for Mortgage Operations

Mortgage firms require a secure cloud-based phone system to connect loan officers and teams on a single platform. Vitel Global delivers an advanced cloud phone system for mortgage firms with VoIP, smart routing, automation, and mobility.

Mortgage Phone System Explained

A cloud phone system for mortgage firms advances communication by routing borrower calls, loan inquiries, and support requests through a cloud-based phone system rather than traditional landlines.

Cloud-based unified communications integrate calling, messaging, and mobility in a single platform. A cloud PBX phone system centralizes routing, loan officer extensions, automated borrower lines, and multi-branch communication using secure VoIP telephone systems.

Why a Cloud Phone System Matters for Mortgage Firms

Traditional phone systems slow borrower communication, limit mobility, and fail to scale across teams and branches. A modern cloud phone system for mortgage firms solves this with fast routing, automation, and mobile access.

A cloud business phone system reduces missed calls, enhances response times, and supports loan officers and teams managing high call volumes—without costly hardware upgrades.

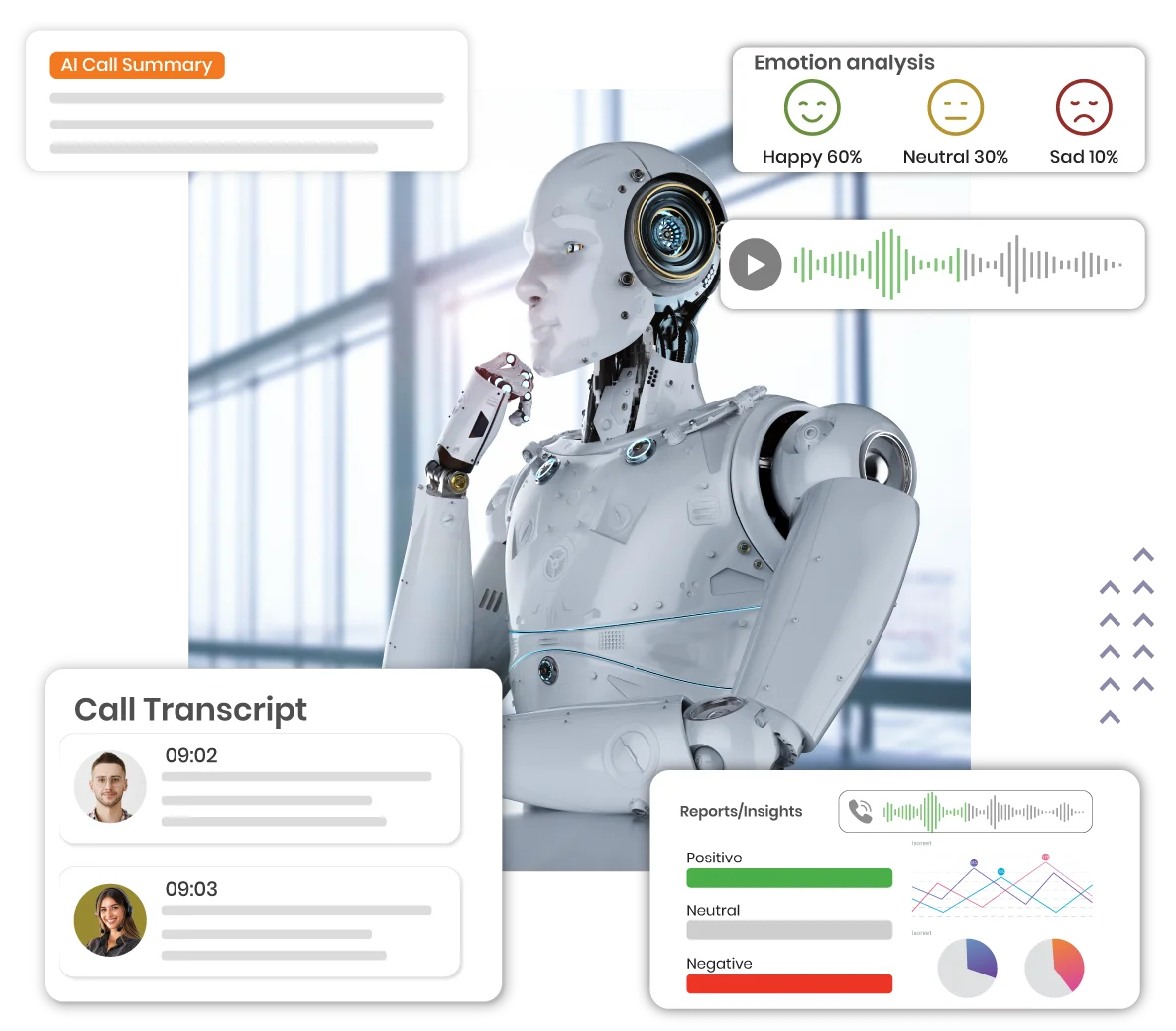

AI-Powered Features for Smarter Mortgage Communication

AI transforms borrower and internal calls into summaries, transcripts, sentiment insights, and tasks—making your cloud phone system for mortgage firms smarter, faster, and easier to handle.

AI Calling Features

-

AI Call Summaries & Transcripts

Instant Summaries : Automatically capture borrower discussions, loan inquiries, document requests, and follow-up actions after each call.

Speaker Clarity : Generate speaker-labeled transcripts so loan officers and managers can review conversations accurately.

Easy Sharing : Replay, download, or securely share call transcripts with loan officers, processors, underwriters, or compliance teams.

-

AI Call Sentiment Analysis

Emotion Detection : Identify borrower sentiment during application discussions, status updates, or support conversations.

Engagement Tracking : Analyze tone and engagement levels across borrower, broker, and internal team calls.

Secure Insights : Share sentiment-tagged insights securely with authorized mortgage managers or leadership teams.

-

AI Call Insights & Reporting

Insight Categorization : Convert mortgage calls into organized insights categorized by loan stage, borrower type, or inquiry purpose.

Trend Identification : Detect trends in borrower concerns, approval delays, or documentation issues.

Automated Reports : Receive AI-generated call reports automatically through your cloud business phone system.

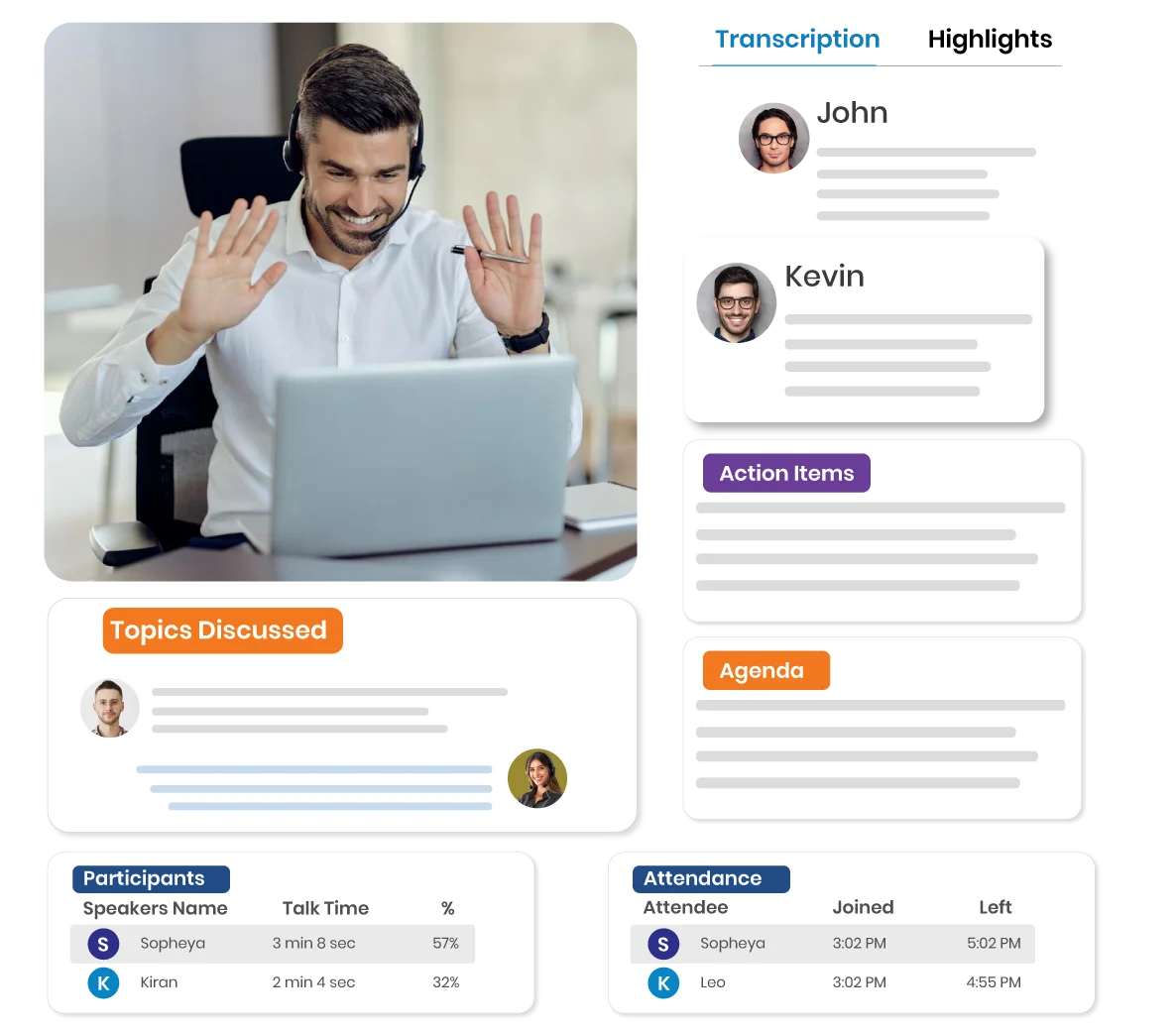

AI Meeting Features

-

AI Meeting Summaries & Highlights

Meeting Capture : Automatically capture loan review meetings, pipeline discussions, and compliance syncs without manual notes.

Transcript Accuracy : Generate speaker-tagged transcripts for audits, training, or regulatory reviews.

Replay Access : Replay or securely share meeting summaries and recordings anytime.

-

AI Meeting Action Items

Task Identification : Automatically identify follow-ups from loan reviews, underwriting discussions, or team meetings.

Agenda Linking : Link notes and tasks directly to loan stages, deadlines, or meeting objectives.

Secure Assignment : Share action items securely with loan officers and processing teams for accountability.

-

Meeting Records & Playback Tools

Session Replay : Replay meetings for training, onboarding, or compliance verification.

Secure Storage: Securely store and download meeting recordings and transcripts

Participation Tracking : Track attendance and participation across loan officers, processors, and management teams.

Core VoIP Features Built for Mortgage Operations

Strengthen borrower and internal communication with cloud-based tools designed for loan processing, underwriting, compliance, and multi-branch coordination.

- Call Management

- Call Management

- Mobility & Access

- Messaging & Voicemail

- Recording & Analytics

- Integrations

- Reliability & Security

Call Management

IVR Menus : Route borrower calls to loan origination, processing, underwriting, or support quickly and accurately.

Virtual Receptionist : Deliver automated greetings and guided menu navigation for borrowers and partners.

Call Queueing : Manage high borrower call volumes efficiently during peak application periods.

Call Routing : Instantly direct calls to the correct loan officer, department, or branch.

Multi-Ring & Call Flip : Answer calls across desk phones, mobiles, or softphones seamlessly.

Ring Groups : Connect loan officers, processors, or support teams for faster borrower responses.

Mobility & Access

Mobile App : Loan officers can answer business calls from anywhere securely.

Desktop App : Manage inbound and outbound calls directly from office systems.

Find Me / Follow Me : Redirect borrower calls across devices or branch locations automatically.

Hot Desking : Perfect for shared desks in branch offices or rotating loan teams.

Messaging & Voicemail

Voicemail & Messaging : Centralize borrower messages for faster follow-ups across teams.

Voicemail Transcription : Read voicemails instantly when teams are occupied.

Email Audio Delivery : Forward borrower call recordings securely to inboxes.

Call Blocking : Reduce disruptions by blocking spam or unauthorized callers.

Recording & Analytics

Call Recording : Support quality monitoring, training, and compliance audits.

Call Analytics : Track call volumes, response times, and borrower engagement trends.

Caller Info Match : Identify returning borrowers or partners automatically.

Dynamic Caller ID : Display accurate branch or company identity on outbound calls.

Integrations

CRM & LOS Integrations: Sync call activity with mortgage CRMs and loan origination systems.

Productivity Platforms : Integrate with Microsoft Teams or Google Workspace seamlessly.

Client Management Tools : Improve borrower tracking with Salesforce or HubSpot integrations.

Helpdesk Systems : Support internal IT and operations teams efficiently.

Cloud-Based Solutions : Enable firm-wide communication and workflow automation.

Reliability & Security

Encrypted Calling : Protect borrower conversations and sensitive loan information.

High Uptime : Ensure reliable communication across branches and teams.

Failover Support : Automatically reroute calls during network or system issues.

Compliance Controls : Support regulatory requirements with secure VoIP and access controls.

Benefits of a Cloud Phone System for Mortgage Firms

Improve borrower coordination, strengthen client communication, and simplify lending operations with a cloud phone system for mortgage firms.

Fewer Missed Borrower Calls

Intelligent routing ensures borrower inquiries, loan status calls, and partner requests reach the right loan officer immediately.

Faster Response Times

Automated IVR menus and call queues help mortgage teams manage high call volumes efficiently during peak application periods.

Better Team Collaboration

Loan officers, processors, underwriters, and support teams stay connected through unified communication tools across all devices.

Stronger Borrower Engagement

Borrowers receive timely updates through organized call flows, voicemail transcription, and faster callbacks throughout the loan lifecycle.

Lower Communication Costs

Cloud-based calling eliminates on-premise hardware and reduces monthly communication costs for mortgage firms.

Multi-Branch Coordination

Branch offices, remote loan officers, and centralized teams manage communication through shared routing, extensions, and reporting.

Improved Communication Accuracy

Call recordings and voicemail-to-email ensure critical borrower and loan details are captured accurately every time.

How Vitel Global VoIP Works for Mortgage Firms

Improve borrower and internal communication with a fast cloud phone system for mortgage firms that connects teams and simplifies daily lending coordination.

Cloud Setup & Activation

Your cloud phone system activates instantly, assigning numbers, extensions, and routing for loan officers, processors, underwriters, support teams, and branch offices—without hardware or on-site installation.

Configure Menus, Routing & Loan Lines

Set up IVR menus for loan applications, status updates, underwriting, customer support, and branch directories, ensuring every borrower call reaches the right team through intelligent routing.

Connect Devices & Go Live

Connect desk phones, mobile apps, and softphones while administrators centrally manage routing, analytics, voicemail, and system settings from a secure, unified cloud dashboard.

Ready to Simplify Mortgage Communication?

Improve borrower responsiveness, team coordination, and multi-branch call management using a secure, scalable cloud phone system for mortgage firms.

Mortgage Use Cases

Enhance lending communication with VoIP workflows designed for loan officers, borrowers, processors, underwriters, and multi-branch coordination.

Why Choose Vitel Global for Your Mortgage Cloud Phone System?

Enhance borrower and internal communication with a secure, scalable cloud phone system for mortgage firms.

AI-Enhanced Communication Intelligence

AI delivers call summaries, sentiment insights, and automated reports to help loan teams respond faster and improve borrower conversations.

Unified Cloud Communication Platform

Calls, messaging, meetings, and analytics operate together, reducing communication gaps across loan officers, processors, underwriters, and support teams.

Smart Call Flow Automation

IVR, routing rules, and ACD ensure borrower calls, loan inquiries, and support requests reach the correct team instantly.

Multi-Branch Number Flexibility

Mortgage firms activate local or toll-free numbers to streamline borrower access and scale communication across branches effortlessly.

24/7 Dedicated Support Team

Mortgage teams receive continuous technical support, guided onboarding, and fast issue resolution whenever needed.

What Mortgage Leaders Say

Frequently Asked Questions

-

How does a VoIP phone system work for mortgage firms?

A VoIP phone system routes borrower and internal calls over the internet instead of legacy landlines, improving reliability and call handling. A cloud phone system for mortgage firms automates borrower inquiries, loan status calls, document follow-ups, and multi-branch communication using IVR menus, call queues, and intelligent routing.

-

Can the system integrate with our CRM or LOS platforms?

Yes. A cloud based business phone system integrates with mortgage CRMs, loan origination systems (LOS), and helpdesk platforms. These cloud phone service integrations provide instant caller context, improve workflow efficiency, and unify communication across cloud-based lending systems.

-

Is a cloud phone system suitable for small mortgage firms?

Absolutely. A small business VoIP phone system works well for boutique mortgage firms and growing lenders. It reduces hardware dependency, supports mobile loan officers, scales easily, and delivers essential VoIP telephone system features without the high cost of traditional business phone systems.

-

How secure is cloud communication for mortgage operations?

A cloud phone system for mortgage firms protects borrower and staff communication through encryption, secure cloud data centers, fraud monitoring, MFA, and access controls. This ensures calls, messages, voicemails, and recordings remain private and compliant across cloud-based VoIP systems.

-

Can we keep our existing business phone numbers?

Yes. With number porting, mortgage firms can move existing business phone numbers into their new cloud phone system without downtime. This maintains communication continuity while gaining advanced routing, mobility, and automation benefits from modern VoIP telephone systems.

Ready to Modernize Your Mortgage Communication?

Enhance borrower engagement, team coordination, and multi-branch operations with Vitel Global’s cloud phone system for mortgage firms.

Schedule Demo Now